39+ Calculating Bonds In Excel

Dates should be entered by using the DATE function or as results of other formulas or. In cells B1 through B4 input the respective values for each label mentioned.

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Web More videos at httpfacpubstjohnsedumoyrvideoonyoutubehtm.

. Web The formula used to calculate the Yield is. Use the following steps in Excel to determine the YTM interest rate of a bond. For example suppose a 30-year bond is issued.

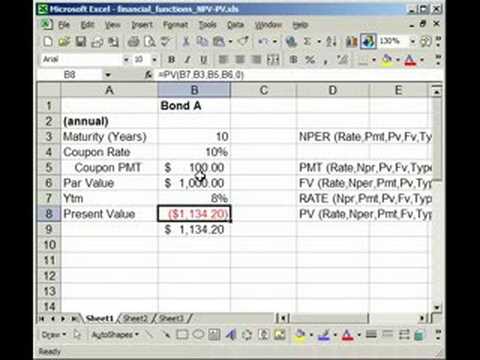

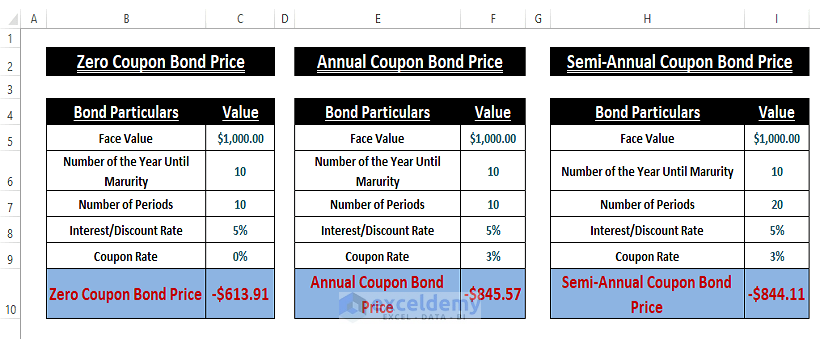

Web This video shows how to compute the present value of bonds in two basic examples0000 Face Value Maturity Coupon Rate YTM0209 Example 1. Web A bond value calculator capable of accurately determining the current value of a bond can be easily assembled in a Microsoft Excel spread sheet. Calculate Price of a corporate bond.

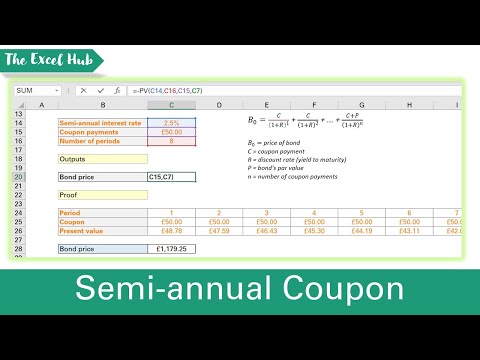

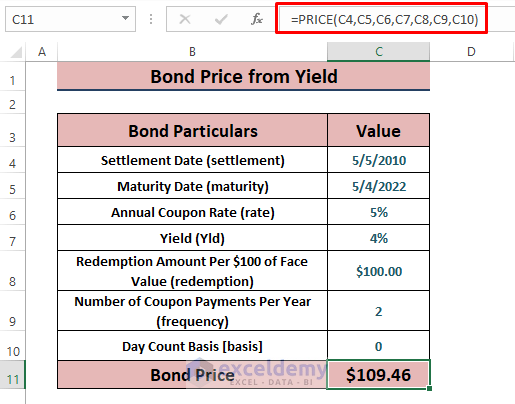

Web The Excel PRICE function calculates the price of a bond or security per 100 face value which also pays period interest. PV 25 20 25 1000 0 This formula tells Excel to calculate the present. Bonds excel finance I have some additional videos on Bon.

Once created the desired data. Web YIELD settlement maturity rate pr redemption frequency basis Important. Assume that you want to find the YTM of.

The maturity date is the date when a coupon expires. Web Open a new Excel workbook. YIELDC4C5C6C7C8C9C10 The YIELD function calculates the yield of the 10-year bond.

Web The settlement date is the date a buyer purchases a coupon such as a bond. Web In the box beside the words Or select a category click the drop-down menu and select Financial. Web Calculating the Yield to Maturity Interest Rate of a Bond.

Assume that you want to find the YTM of a 1000 35 bond with annual. You can then scroll to find the NPV function. Web In this video I show you how to easily calculate a Bond Price using the Price function in Excel.

Web To calculate the present value of the coupon payments we can use the following formula in Excel. Web Use the following steps in Excel to determine the YTM interest rate of a bond. Web This open-access Excel template is a useful tool for bankers investment professionals corporate finance practitioners portfolio managers and anyone preparing a corporate.

In cells A1 through A4 enter the following labels.

How To Calculate A Bond S Yield To Maturity Using Excel Youtube

Calculate Bond Price From Yield In Excel 3 Easy Ways Exceldemy

:max_bytes(150000):strip_icc()/thinkstockphotos-479586547-5bfc34cf46e0fb00514690c4.jpg)

How To Calculate Pv Of A Different Bond Type With Excel

Bond Valuation Price Function In Excel Youtube

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Calculate The Yield To Maturity Of A Bond In Excel Youtube

How To Calculate Bond Price In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Price Formula Excelchat Excelchat

Bond Prices And Durations In Excel Youtube

Russia Cds Trades Are Now Showing In Sbsdr Data

How To Calculate The Price Of A Bond In Excel Youtube

39 Financial Analysis Samples Pdf Word

Bond Prices And Durations In Excel Youtube

How To Calculate Bond Price In Excel 4 Simple Ways Exceldemy

Bond Valuation Price Function In Excel Youtube

Calculating Bond S Yield To Maturity Using Excel Youtube