Total gross annual income calculator

Entering values the calculator displays the total amount of MAGI. Total Actual Annual Income.

Agi Calculator Adjusted Gross Income Calculator

Lenders take your monthly gross income and debt payments and calculate your debt-to-income ratio.

. Assets and other money under Section 69A valuables like money jewellery etc for which no proper explanation is available with the assessee will be added to the Gross Total Income of the person. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Calculate annual gross income.

There is an annual. If your net income on rent is above 3783 your investment is most likely doing well. This calculator helps you determine the gross paycheck needed to provide a required net amount.

In particular DTI ratio is a percentage that compares your total monthly debts to your gross monthly salary. This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b. The formula for total cost can be derived by using the following five steps.

Additional formulas to calculate rate of return on rental property. The gross operating income multiplied by the vacancy rate. Your debt-to-income ratio represents the maximum amount of your monthly gross income that you can spend on total monthly housing expense plus monthly debt payments such as auto student and credit card loans.

Federal Income Tax Calculator 2022 federal income tax calculator. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses. Estimated Gross Rental Income Property Price Gross Rent.

This salary calculator estimates total gross income which is income before any deductions such as taxes workers compensation or other government and employer deductions. Enter the Total Annual Income from Properties. Qualified educator expense deductions are capped at 250.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Whereas gross salary is the amount you pay before taxes your net salary is the amount of pay you receive after all taxes have been deducted. First find your gross annual rental income and then input the income and GRM into the estimated property price formula.

Your gross annual rental income would be 2000 x 5 units x 12 months 120000. Some examples of the fixed cost of production are selling expense rent expense. The 2022 Annual Tax Calculator calculates your take home pay based on your Annual Salary.

The calculator allows you to apply expenses to calculate the total expenses you cover as a landlord. Note that gross annual income is taken into account for the calculation of annuities plans and insurance. Gross Pay or Salary.

What are the different types of Income-Driven Repayment plans. Income multiplies the federal poverty line for your family size by 15 then subtracts that from your adjusted gross income. Some people refer to this calculation as a unit rate conversion.

Lets work through how to calculate the yearly figure by using a simple example. Generally a high DTI ratio means you are not in a good position to acquire more debt. This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR.

Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. If you make 55000 a year living in the region of New York USA you will be taxed 11959That means that your net pay will be 43041 per year or 3587 per month. Your average tax rate is 217 and your marginal tax rate is 360This marginal tax rate means that your immediate additional income will be taxed at this rate.

Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Income tax calculator for Ontario and Canada gross income of 2022 tax return that needs to be made in 2022. That cost which do not change with the change in the level of production.

Next take the total hours worked in a year and multiply that by the average pay per hour. The Landlord Income Tax Calculator is designed to be intuitive to use its all about making income tax easy to calculate and understand. Click here for a 2022 Federal Tax Refund Estimator.

Calculate your Annual take home pay based of your Annual salary to see full calculations for Pay As You Earn PAYE National Insurance Contributions NICs Employer National Insurance Contributions ENICs Pension Dividend tax etc. Calculate the value of AGI. Calculate the total income taxes of the Ontario residents for 2022.

Assume that Sally earns 2500 per hour at her job. Total Cost 20000 6 3000. So it will be an additional of all income which a personcompany would have possibly got through a salary or bproperty or c business or d capital gains or e other resources.

Add certain allowable deductions. Undisclosed or lower disclosed income is added to the Gross Total Income as per the provisions of Section 69B of the Income Tax Act 1961. Current Redmond mortgage rates are shown beneath the calculator.

While increasing your retirement account savings does lower your take home pay it. The net income is the result of the total income all sources of revenues also called gross income where all taxes and other deduction has been subtracted. Estimated Property Price 120000 x 5 units 600000.

1850 x 22 40700. Gross Total Income ab. How to Use the Landlord Income Tax Calculator.

First enter the net paycheck you require. There are some restrictions on specific AGI deductions to note when using our gross income calculator. Subtract the vacancy amount from the GSI and then add other income.

Other Income laundry late fees etc Gross Operating Income GOI. The sum of all. To know if you are a suitable candidate for a health insurance loan you need to calculate the value of the MAGI.

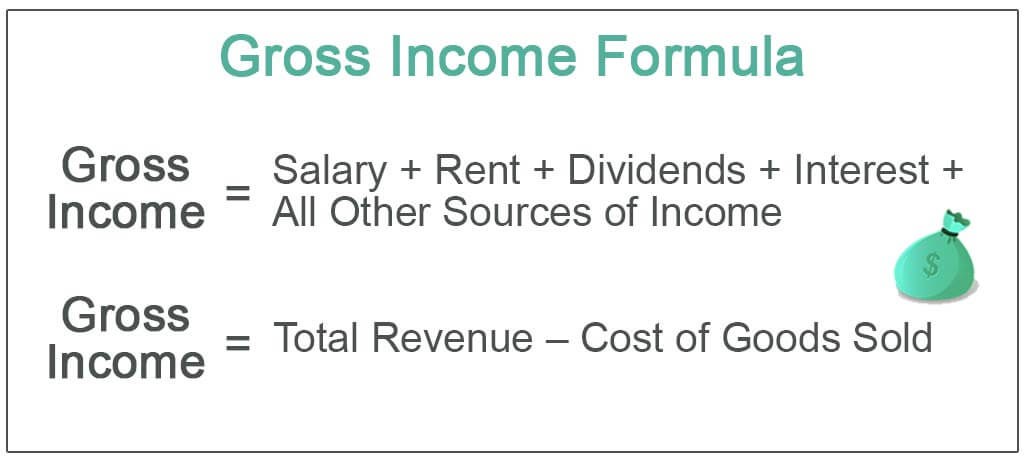

Gross Income- Gross Income is the income amount an individual gets from the employer or a company gets before any deductions or taxes. Net salary calculator from annual gross income in British Columbia 2022. How much of your monthly salary goes to your debts.

All sources of gross income include. Modified adjusted gross income calculator Example. So if on your gross salary of 22000 you pay 1800.

Firstly determine the cost of production which is fixed in nature ie. Example of Annual Income Calculator. Gross vs Net Income.

The annual income collected after you deduct the vacancy amount. Our rental income calculator includes the gross yield cap rate and cash ROI in addition to the annual return and total return to give you a holistic view of your potential return on investment. School tuition and fees are capped at 2500 with 100 percent of the first 2000 and then 25 percent of the next 2000 eligible as a deduction.

Total Cost 38000 Explanation.

Annual Income Calculator

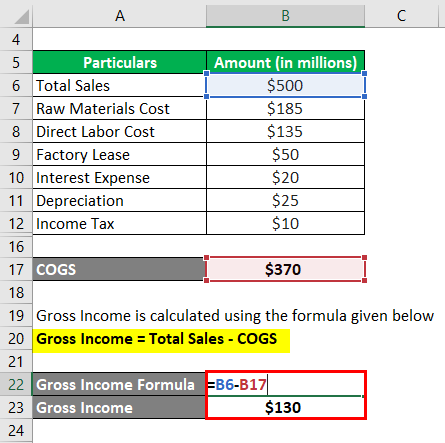

Gross Income Formula Calculator Examples With Excel Template

How To Calculate Gross Pay Youtube

Calculating 1 3 Of Your Income

Gross Income Formula Calculator Examples With Excel Template

Hourly To Salary What Is My Annual Income

Gross Income Formula Step By Step Calculations

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Definition Calculation And Quiz Business Terms

4 Ways To Calculate Annual Salary Wikihow

Salary Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Calculator Examples With Excel Template

Monthly Gross Income Calculator Freeandclear

Gross Income Formula Step By Step Calculations